You now have the ability to use WeIntegrate’s sync between Shopify and QuickBooks Online to improve how you manage Physical and Economic Tax Nexus in QBO! This is particularly useful when multiple locations are part of the business operations, which Shopify supports, and is a limitation of QBO.

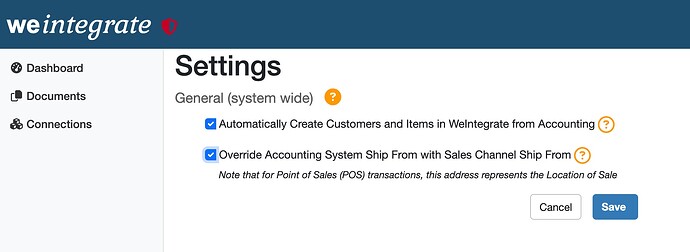

By default, WeIntegrate’s General Settings has a checkbox option labeled, Override Accounting Ship From with Sales Channel Ship From enabled, which works as follows:

-

When customers place order on your clients’ Shopify store, before integrating the sales to QBO, our app compares the Ship-to State of each sale to physical locations setup within Shopify (including multiple warehouses, offices, etc).

-

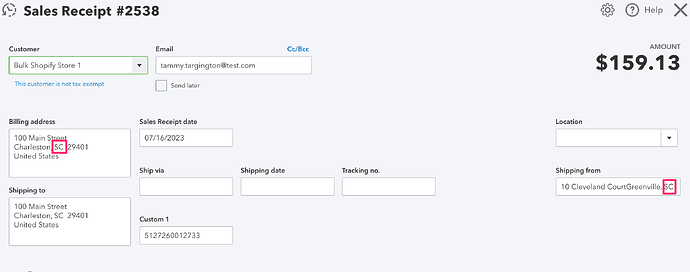

If the Ship-to State of a sale matches the state associated with any of the physical locations setup in Shopify, the matched physical location from Shopify is used to replace the Shipping From address on the QBO Sales Receipt.

-

This maintains Physical Nexus of a QBO Sales Receipt as application.

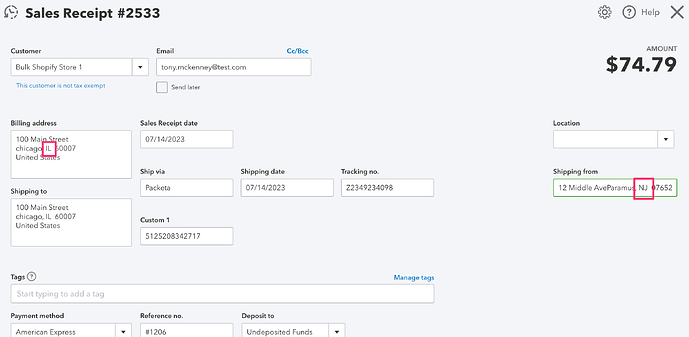

- Alternatively, if there is no match of state between a Shopify Sales’ Ship-to and any of the physical locations setup in Shopify, the QBO Sales Receipt Shipping From address is set as the QBO default company address, and constitutes Economic Nexus.

- By using QBO’s Economic Nexus management tool, you have clarity in tracking Economic Nexus Thresholds, knowing that your Physical Nexus sales are 100% accurate.

How Does This Work for Point of Sale (POS)?

For POS Sales where customers are walking into a physical building and taking the products with them (e.g. no shipping needed), the physical location of each store is used in the QBO Sales Receipt Shipping From field (which QBO automatically renames to Location of Sale).

This is particularly effective when one Shopify Account has multiple Shopify Store Locations and pop-up locations associated with it.